Some Of Mileagewise - Reconstructing Mileage Logs

Some Of Mileagewise - Reconstructing Mileage Logs

Blog Article

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Buzz on Mileagewise - Reconstructing Mileage LogsA Biased View of Mileagewise - Reconstructing Mileage LogsFascination About Mileagewise - Reconstructing Mileage LogsThe 20-Second Trick For Mileagewise - Reconstructing Mileage LogsThe 8-Minute Rule for Mileagewise - Reconstructing Mileage LogsThe Facts About Mileagewise - Reconstructing Mileage Logs UncoveredThe Greatest Guide To Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Distance function suggests the shortest driving route to your workers' destination. This attribute improves productivity and adds to cost savings, making it an important property for companies with a mobile labor force. Timeero's Suggested Route feature further boosts accountability and efficiency. Employees can contrast the recommended route with the real course taken.Such a method to reporting and compliance simplifies the typically intricate job of managing gas mileage expenditures. There are several advantages connected with using Timeero to keep track of mileage. Allow's have a look at a few of the application's most noteworthy attributes. With a trusted mileage tracking tool, like Timeero there is no requirement to stress over mistakenly leaving out a date or piece of details on timesheets when tax time comes.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

These extra verification steps will keep the IRS from having a reason to object your mileage documents. With precise gas mileage tracking modern technology, your employees don't have to make harsh gas mileage estimates or even fret regarding mileage expense tracking.

As an example, if an employee drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile expenses. You will need to continue tracking mileage for job also if you're utilizing the actual cost method. Maintaining gas mileage records is the only way to separate service and personal miles and give the evidence to the IRS

A lot of gas mileage trackers let you log your trips by hand while calculating the distance and repayment amounts for you. Many likewise included real-time trip tracking - you need to start the application at the beginning of your trip and quit it when you reach your last location. These apps log your start and end addresses, and time stamps, along with the total range and reimbursement amount.

4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

One of the concerns that The INTERNAL REVENUE SERVICE states that vehicle costs can be taken into consideration as an "regular and necessary" cost in the training course of operating. This includes prices such as gas, upkeep, insurance coverage, and the vehicle's depreciation. For these expenses to be thought about insurance deductible, the car must be used for business objectives.

The 25-Second Trick For Mileagewise - Reconstructing Mileage Logs

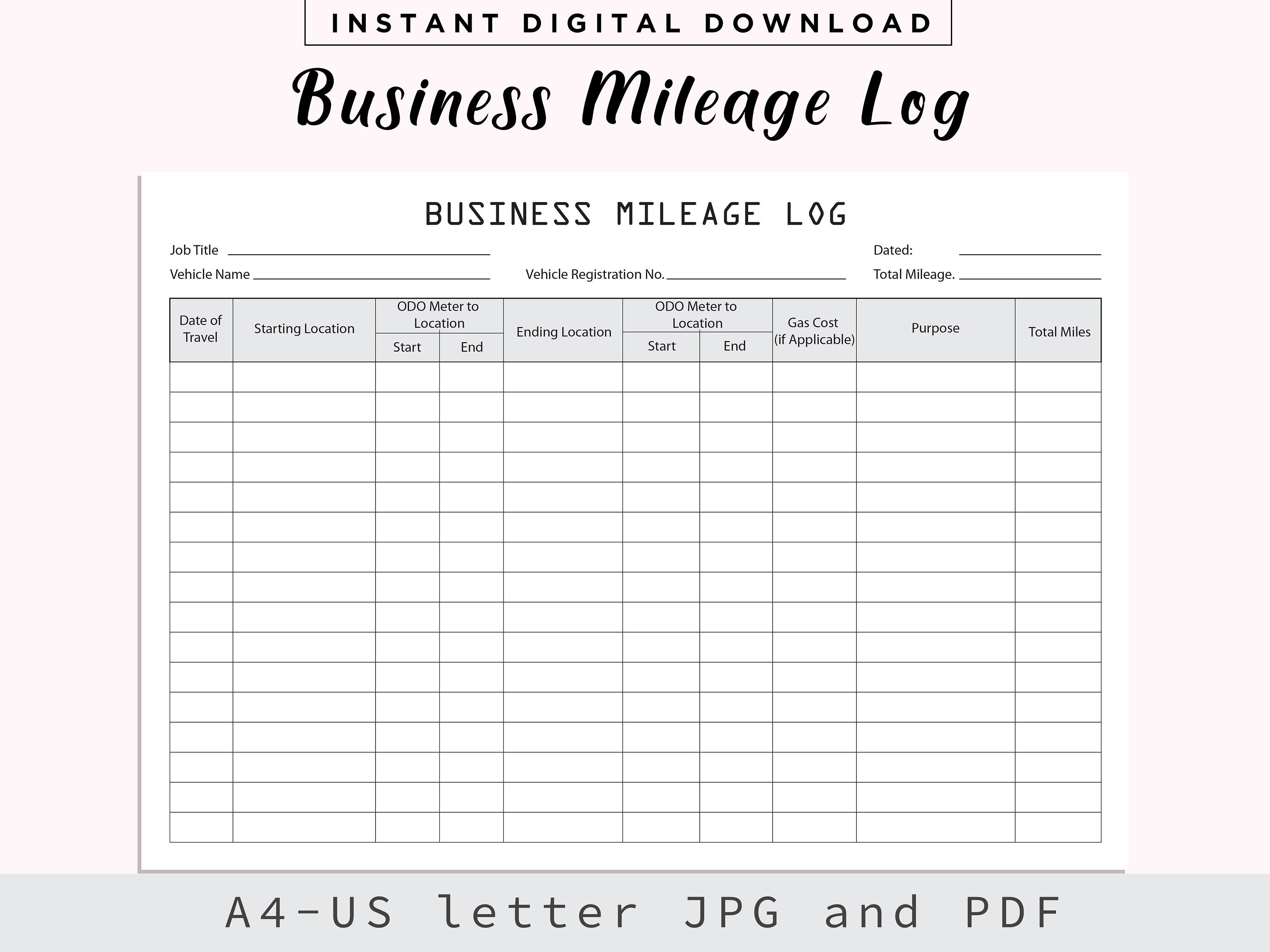

Beginning by videotaping your auto's odometer reading on January first and afterwards once again at the end of the year. In between, diligently track all your organization journeys writing the beginning and finishing readings. For each journey, document the location and organization function. This can be simplified by keeping a go to my site driving visit your car.

This includes the complete company mileage and complete gas mileage buildup for the year (organization + individual), journey's date, location, and objective. It's vital to tape tasks quickly and preserve a coexisting driving log outlining day, miles driven, and service objective. Right here's exactly how you can improve record-keeping for audit purposes: Begin with guaranteeing a precise mileage log for all business-related travel.

Facts About Mileagewise - Reconstructing Mileage Logs Revealed

The actual expenses approach is a different to the standard mileage rate approach. Instead of calculating your deduction based on an established rate per mile, the actual costs method allows you to deduct the actual expenses related to utilizing your vehicle for business functions - best free mileage tracker app. These expenses include gas, maintenance, repairs, insurance coverage, depreciation, and other related costs

Those with substantial vehicle-related expenditures or special conditions might benefit from the actual expenses method. Ultimately, your selected method ought to align with your details economic objectives and tax obligation situation.

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

(https://dc-washington.cataloxy.us/firms/www.mileagewise.com.htm)Calculate your total service miles by using your beginning and end odometer analyses, and your tape-recorded company miles. Precisely tracking your precise mileage for organization journeys help in confirming your tax deduction, specifically if you opt for the Standard Gas mileage technique.

Maintaining track of your gas mileage by hand can call for persistance, however remember, it might conserve you money on your tax obligations. Tape the total mileage driven.

Mileagewise - Reconstructing Mileage Logs - Truths

In the 1980s, the airline company industry became the very first commercial customers of GPS. By the 2000s, the delivery market had actually adopted GPS to track bundles. And currently almost every person utilizes GPS to navigate. That implies virtually every person can be tracked as they go about their organization. And there's snag.

Report this page